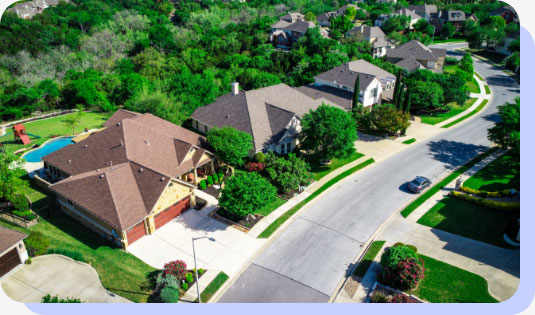

Save up to 40%

on homeowners insurance

Find quality homeowners insurance, conveniently and cost-effectively with 2-10 Insurance Services.

Get a quote Or call 800.414.6780Why 2-10 Insurance Services

Homeowners insurance is essential. It can also be complex, confusing, and costly.

2-10 Insurance Services does the hard work of finding you high-quality homeowners insurance, conveniently and cost-effectively.

How it works

2-10 Insurance Services has a simple process to help you save up to 40% on homeowners insurance coverage you can trust.

We work with some of the best, most well-known insurance companies in the nation.

We compare those companies for you to find the best coverage at the lowest cost.

You save up to 40% on homeowners insurance that fits your needs.

With 2-10 Insurance Services, finding coverage is more convenient

There are many different types of homeowners insurance, and many things for you to consider. To start, there are several kinds of homeowners policies, usually ranging from HO-1 to HO-8. Here are some of the policies likely to affect you.

HO-3 coverage

his the most common type of homeowners insurance. It protects your dwelling and belongings against things like fire, theft, and natural disasters. It also could include liability coverage if someone were to get hurt or die at your home.

HO-5 coverage

May be better if you own a brand-new home, especially because HO-5 provides coverage for structures and personal belongings at replacement cost (i.e., at their value when first purchased, which may be advantageous to new-home owners).

HO-8 coverage

May be best if you own an older or historically significant home.

- Plus, you’ll likely consider whether you want a named peril policy, which covers specific kinds of perils listed in the policy, or an open peril policy, which can offer more coverage for specific perils.

- Additionally, you’ll need to think about the level of coverage you want: actual cash value, replacement cost, or extended cost.

- You may also be interested in additional types of coverage, such as flood, earthquake, umbrella, and auto.

Here are some of the various kinds of coverage potentially available to you.

| Policy | Type | Dwelling | Liability | Belongings |

|---|---|---|---|---|

| HO-1 | Basic | |||

| HO-2 | Basic | |||

| HO-3 | Special | |||

| HO-4 | Renters | |||

| HO-5 | Comprehensive | |||

| HO-6 | Condo | |||

| HO-7 | Mobile homes | |||

| HO-8 | Older homes |

*The structure is open peril while belongings are under named peril.

Levels of coverage

Actual Cash Value

Covers damages to structures and personal belongings, but includes a deductible due to item depreciation.

Replacement Cost

Covers damages to structures and personal belongings at their value when first purchased.

Extended Cost

Covers damages to structures and personal belongings past the original value, if necessary.

Feeling overwhelmed?

We’re here for you.

Your coverage should fit your needs and budget without overwhelming you. 2-10 Insurance Services helps you find the coverage you need so you can enjoy your life.

- You give us some information about your needs.

- We compare costs and carriers for you.

- You get peace of mind that your coverage does what you need at a price you want.

Plus, our agents can help you fill potential gaps that your current coverage doesn’t include.

These additional coverages, also called endorsements, can provide even more protection, on top of the savings 2-10 Insurance Services provides you!

Water backup coverage

Covers water damage that occurs due to backed-up drains, sewage systems, and sump pumps

Home business coverage

Extends financial protection for business property in the home, and can cover expenses if a client or employee is injured on your property

Service-line coverage

Reimburses for damage to backed-up or punctured utility lines, such as natural gas lines, internet cables, and sewer pipes

Scheduled personal property coverage

Raises payout limits on more-expensive items—such as jewelry, firearms, and musical instruments—and can insure such items against misplacement

And much more! Contact your 2-10 Insurance Services agent for details!

Do I need homeowners insurance and a Home Warranty Service Agreement?

The coverage homeowners insurance provides rarely overlaps with the coverage a Home Warranty Service Agreement provides. A Home Warranty Service Agreement could cover breakdowns to your heating and cooling system, water heater, refrigerator, and more that homeowners insurance may not cover. Having both can help you protect more and pay less when the unexpected occurs.

2-10 Insurance Services and 2-10 Home Buyers Warranty (2-10 HBW) are part of the 2-10 suite of solutions and services. 2-10 HBW offers offer Home Warranty Service Agreements to help you protect your home’s important items against routine breakdowns.

A Home Warranty Service Agreement and homeowners insurance complement each other, giving you more coverage for the unexpected.

See the differenceWe can help you find additional coverage you need

2-10 Insurance Services partners with leading insurance companies so you can focus on enjoying life in your home. See how we can help protect the things that make your house a home.

Flood

Insurance

Earthquake

Insurance

Umbrella

Insurance

Auto

Insurance

Frequently asked questions

2-10 Insurance Services is an insurance agency that shops quotes among some of the top insurance carriers. From homeowners and auto insurance to flood and earthquake coverage, we help homeowners protect more and pay less for quality coverage, conveniently and cost-effectively.

We can help you find coverage options that fit your needs. Let us give you confidence in home protection so you can enjoy the important moments in life.

It's a good idea to review your coverage and carrier every year. In fact, it's a best practice to compare quotes among 5 different carriers. 2-10 Insurance Services can help you find comparable coverage at a lower price among 30 high-quality carriers.

We shop policies and quotes among some of the top carriers for you, based on your needs. That gives you the confidence and convenience of quality, cost-effective coverage. Plus, we can potentially save you even more when you bundle homeowners insurance with auto insurance or other coverage.

Where we do business—License numbers

We are currently licensed in 46 states. Our corporate office is located at: 13900 E Harvard Ave, Aurora, CO 80014.

View all licensed service areasGet started on happy home ownership

Protecting your home and personal property should be simple and affordable. Let us get you started on happy home ownership by helping you find a discount of up to 40% on home insurance.

Get a quote