When Your Buyer Has FHA Financing:

HUD-Approved Warranties

Does this situation sound familiar? You've scheduled a closing date, then the mortgage company calls

with another requirement — you need to provide a HUD-approved 10 year warranty on the home.

It's a scenario that many builders have encountered: They get to the closing table with a buyer, only to find that there are additional requirements to fulfill when the buyer is using a FHA loan for their mortgage.

What do you do, and where do you go, to acquire this coverage?

If a lender has instructed you to get a warranty from a HUD-approved company, 2-10 HBW can fulfill those requirements. You can even have your approval in 72 hours or less. If you're working on a tighter timeline, just give us a call at 877.777.1344 and we can discuss your options.

Do I need a HUD-Approved Warranty for My Builds?

When you have a buyer with an FHA, VA, or RHS loan, the mortgage underwriter ultimately controls whether you need to provide a warranty from an approved company. Sometimes, they accept local inspections. Other times, you'll be required to secure a HUD-approved warranty.

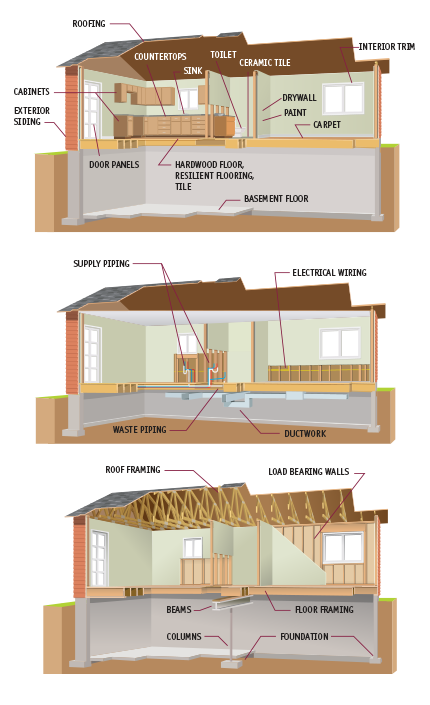

HUD requirements for new home warranties include:

- 1-year surety coverage against defects in the workmanship and materials.

- 2-year surety coverage against defects in systems delivery

- 10-year coverage against structural defects in the home.

On the Phone, Online, and In-Person: Getting Approved for a 10-Year Warranty

Builders like you can easily submit an application for 10-year warranty approval in 3 different ways:

- Complete the standard application online

You'll need your federal ID number, basic information about the last 3 years of your business (including how many homes you've built, the average sales price, quantity of homes you plan to build in the next 12 months, and the average price of those homes). - Call us at 877.777.1344

If you're on a job or in a time crunch and have all of the necessary information, we've even helped builders fill out and submit their applications right from the job site. A representative will help you fill out the application, then all that's required is an electronic signature. - Meet with one of our local Risk Management Specialists. We have a nationwide risk management team covering 48 states.

No matter how you choose to complete the application, the process is easy, stress-free, and fast — it's not unheard of for the application to take less than 10 minutes to complete.

You'll get through closing faster so that you can continue doing what you do best — building homes. Plus, no tax returns, profit and loss statements, or buyer names and contact information are required to complete the application.

Easy, stress-free and fast application

No matter how you choose to complete the application, the process is easy, stress-free, and fast — it's not unheard of for the application to take less than 10 minutes to complete.

You'll get through closing faster so that you can continue doing what you do best — building homes. Plus, no tax returns, profit and loss statements, or buyer names and contact information are required to complete the application.

Benefits Beyond HUD Requirements

Structural warranties, such as the kind offered by 2-10 HBW, do far more than help builders meet HUD requirements when working with buyers who have secured a FHA loan.

Sell more homes

Most home buyers feel more comfortable purchasing a home with warranty coverage. One study found that 94% of prospective home buyers said they would be more likely to purchase a home from a builder who offers a structural warranty.

Avoid costly legal battles

As a builder, you want to manage the potential risks that are part of doing business, especially if those risks could lead to costly legal battles if something goes wrong after you've finished building a home. Home builders warranties are part of a comprehensive builder risk management program.

Read More [+]Protect your buyers

Your buyers trust that you’ve built a structurally sound home, but foundations can be fickle. 25% of all U.S. homes will experience some form of structural distress over their lifetime, and 5% of all homes will sustain major structural damages. Warranty coverage ensures that the structural integrity of those homes can be restored without financial headache.

Buyer education is part of the package

Every homeowner can benefit from knowing more about their home, and warranties emphasize educating the homeowner about proper maintenance. When homeowners know more they'll be less likely to come to you about small concerns and minor issues. They'll be empowered to maintain their home properly, ensuring they stay happy with their purchase for years to come.

To get started with 2-10 HBW's HUD-approved warranties for buyers with FHA loans, request a quote today.

get a quoteWhy 2-10 HBW

From building to selling and buying, 2-10 HBW has been in the business of protecting homes with insurance-backed warranties for 38 years. 5.5 million homes in 48 states have been protected from the unexpected, saving builders and homeowners alike from financial surprise.

As a HUD-approved warranty company, we also have to meet certain requirements every 2-3 years to remain a qualified provider. As a result, our HUD-backed written standards are clear about what is covered under the warranty, so there's no confusion.

We also have more field representatives and risk management specialists in the field than all of the other warranty companies combined. Relationships with our customers are the backbone of the business, and we believe that face-to-face interactions are still important.

When you work with 2-10 HBW, your business will have the support it needs from sales to closing to warranty administration. Whether you prefer to communicate online, on the phone, or in person we're here when you need us.

To get started with 2-10 HBW's HUD-approved warranties for buyers with FHA loans, request a quote today.