Understanding the New 2015 TILA-RESPA Integrated Disclosure Rule |

New TILA-RESPA Rule Affects Required Disclosures for Real Estate transactions

The Consumer Financial Protection Bureau (CFPB) enacted the TILA-RESPA Rule (Rule), effective October 3, 2015, that consolidates four existing required disclosures on all closed-end credit transactions secured by real property, which includes nearly all real estate transactions. The new Rule was designed to further protect consumers and provide more clarity than the existing Truth in Lending Act (TILA) and Real Estate Settlement Procedures Act of 1974 (RESPA) disclosures. The Rule integrates existing mandates into 2 new forms (the Loan Estimate and the Closing Disclosure) and details how these documents should be completed, establishes timelines for filing and outlines what changes to these forms are considered material and require amendments and/or additional disclosures.

What this Means

Simply put, this new Rule changes the required disclosure forms for real estate transactions. It imposes new deadlines that require completed documentation and filed in a timelier manner on the front end, and finalized well in advance on the back end prior to closing.

How Does this Affect Real Estate Professionals?

The new TILA-RESPA Rule requires lenders to provide your clients with completed disclosures 3 business days prior to getting to the closing table. If there are material changes made to the loan during this 3 day period, then a new three business day review period will be required.

Non-material changes leading up to closing that do not alter the basic terms of the deal will not require this extra three-day review, but will require that the lender provide an updated Closing Disclosure.

Changes requiring new three-day review:

|

Changes not requiring new three-day review:

|

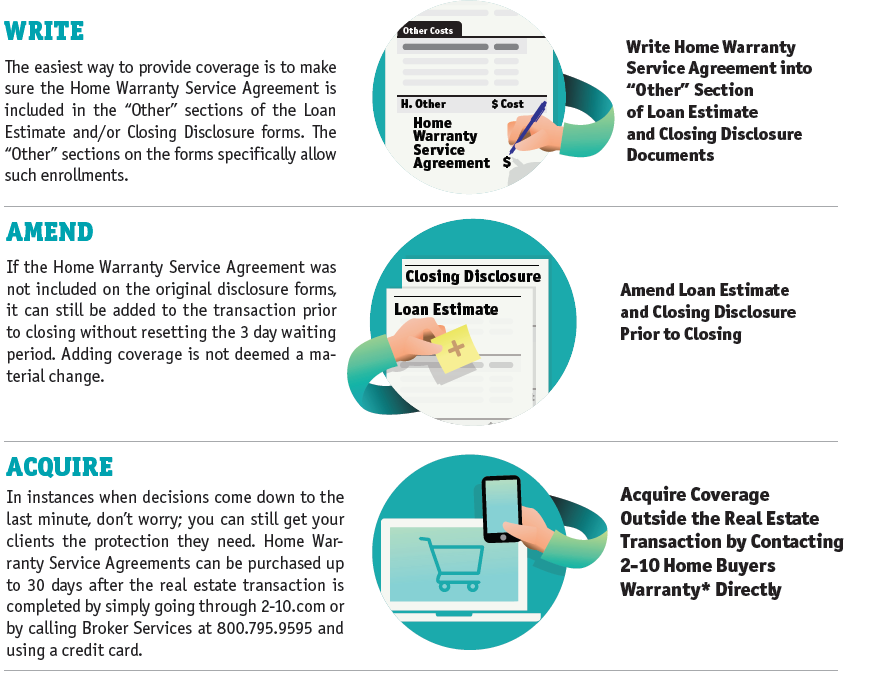

You Can Still Protect Homeowners without Causing Delays to Closing

The good news is that even with this new Rule, ensuring your clients receive the protection they deserve from a Home Warranty Service Agreement does not have to delay closing regardless of where you are in a real estate transaction.

|

Download Summary of How to Enroll Coverage

|

| *CA: 2-10 HBW Warranty of California, Inc. OR (License #: 202003), UT and WA: Home Buyers Resale Warranty Corporation The information contained in this document is intended only as guidance. Since factual situations may vary it is best to consult a legal professional for more detailed information. |

2-10 HBW offers comprehensive systems and appliances home warranties to help protect your clients from unexpected repair and replacement costs. Contact us to learn more.